How a T.I.F. Works and Its Impact

From The Desk of the Superintendent:

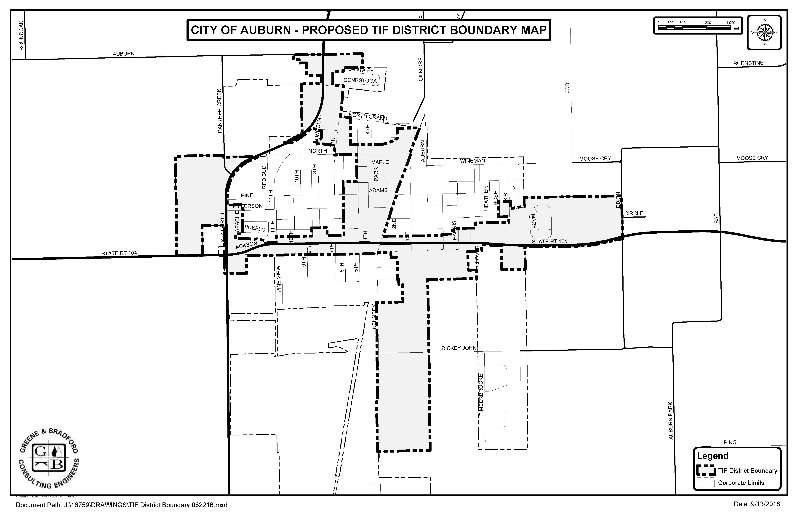

The Auburn City Council is getting poised to vote on the creation of a Tax Increment Financing (TIF) District, but I have found that very few people understand exactly how a T.I.F. works and its impact. Where does the money come from? Who are the winners and who are the losers?

Once a municipality approves a T.I.F. district, the future increases in property taxes within the T.I.F. boundaries are diverted away from the School District, the Fire District, and the Township for the next 23 years. That money is then collected by the City instead. The City then can take your tax money from the T.I.F. fund and give it to private individuals and developers with the intentions that they invest it in their business or development projects. Does the School District lose money as a result of the T.I.F.? Yes.

T.I.F.s do not freeze your taxes. T.I.F.s do not create new revenue either. T.I.F.s change where your tax money goes. Your taxes continue to increase with the assessed value or appreciation of your property.

According to the Illinois Department of Revenue, 2014 Property Tax Statistics, nearly $11.1 billion in Equalized Assessed Valuation is now in T.I.F Districts state-wide. Property growth within the T.I.F.s is excluded from the General State Aid (GSA) calculations. GSA is “Aid” or money from the State of Illinois used to help fund schools; to off-set what local revenue cannot generate. In communities with T.I.F.s, more financial obligation rests on the State of Illinois to fund education. Everyone knows the State of Illinois is broke and these payments to schools are not being made. Even if they were being made, it is nowhere near a dollar for dollar swap. In 2014, nearly $982 million in public tax dollars were diverted from taxing bodies to T.I.F. District funds. Illinois ranks 50th out of 50 in the United States for funding public education. We are dead last. T.I.F.s are one reason why. There is no short term gain.

So, T.I.F.s are not just a potential Auburn problem.

If you follow the money, a portion of the GSA obligation to school districts has increased to pay for T.I.F.s. As a result School, Fire, Library, Park Districts and Townships become the financial losers. Compounding. For 23 years.

The City of Auburn is having a public hearing on the proposed T.I.F., as required by law, at City Hall on Monday, February 6 at 6pm.

Launch the media gallery 1 player - media #1

Launch the media gallery 1 player - media #1